Recent Work

〰️

Recent Work 〰️

Crafting Immersive Product Experiences Through Game Design

A Case-study on Designing for Improving Retention

This is a collection of some of our work at Jar to improve retention, where we used game design principles to create immersive product experiences for users of the Jar app.

Jar - Daily Saving app

A mobile-first platform that transforms daily savings into gold investments, using behavioural psychology and reward systems to build lasting financial habits.

“Drop by drop makes an ocean”- The phrase resonates with most in principle, irrespective of any cultural or demographic boundaries. But it’s a different story to put the principle into action.

The Challenge

Despite universal awareness of the importance of savings, one of the critical barriers that prevent action is “The "Drop-Off Effect" - Even when started, the delayed gratification leads to inconsistency and abandonment.

Value creation

✨ For users: The true value emerges through consistent saving, creating financial security and emergency buffer. Apart from getting rewards, one aspect that our most retained users cherish is how organically their savings grew: “Pata bhi nahi chala aur ek din Jar mein dekha to ₹.15000+ save ho gaya tha” (I didn't even realise it, but one day I opened my Jar app and discovered I had saved over ₹15,000) - This is the true value creation for the users, the magic of invisible saving.

✨ For business: Our strategy centred on two critical business levers: maximising user retention to build sustained engagement while driving revenue growth.

“Gamification is both powerful and flexible — it can readily be applied to any problem that can be solved through influencing human motivation and behaviour.”

– Christopher Cunningham and Gabe Zichermann

Source: Tom-Fisch Burn

Let’s gamify the features

We resisted the temptation and started by asking…

What pain point drives users to Jar, and what lasting value keeps them coming back?

Our approach to addressing the challenge

We began by identifying critical user drop-off points and designing targeted behavioural interventions that sustainably drive key business metrics while helping users achieve their financial objectives.

The next steps were…

⏭️ Engaging with retained users - Analysing data to identify existing user patterns - Extracting the value generated for users through current engagement features

A two-pronged approach

We used game design principles to build new and stitch together existing user touch-points to improve user retention, satisfaction and overall engagement.

Maximise momentum

Achievement unlocked

Streak psychology

Celebrating smaller successes

Social proof

Progress visualisation

Make it meaningful

Micro-learning modules

Savings stories

Goal visualisation

Relatable interactions

Problem Area #1

Motivating users to save a little extra every week

Identified user behaviour

On Jar, users can start saving (daily, weekly or monthly) with autosave and manually as they wish. Some traits that we saw amongst users, that set the foundation for this new engagement feature…

✅ We saw that about 30% of the users who start “Daily Saving” also do a one-time saving with a small amount on the same day.

✅ Users who do not opt for “Daily Saving”, a small percentage of them also do a one-time saving with a small amount on the same day.

⚠️ Frequency of a one-time save (manually save) reduces week-over-week and becomes almost nil from week 3 onwards.

Maximising Momentum - Solution #1

Weekly Magic!

The construct of the game

Weekly Magic (version-1) is 7 day “Mystery Card” collection challenge and repeats every week on Monday.

The user gets a mystery card every time a saving is made.

Each challenge has a different number of mystery cards, 5, 8 and 12 respectively,

Upon completing a challenge, the user wins an “Extra Gold” reward which gets added to their savings,

The saving amount increases as the weekly challenge progresses, the higher the saving, the higher the completion reward,

When a challenge is not complete by the weekend, the same challenge is refreshed for the upcoming week.

Business impact

While initial performance missed targets, strategic optimisation of key user touchpoints transformed our metrics. By introducing contextual entry points at high-intent moments, visualising progress prominently, and crafting personalised re-engagement narratives for dormant users (3+ Days), we achieved significant traction across core KPI - Increase one-time.

Highlights

The 'Mystery Card' mechanic emerged as a powerful driver of user behaviour, accounting for 30% of all manual savings transactions - transforming an engagement feature into a significant lever for core business metrics.

Users with “Daily Saving” active before the start of a new challenge, almost always won the first challenge, reinforcing their saving momentum.

Manual saving for an auto-save user increased from 1 transaction per week to an average of 2.7 transactions.

While Weekly Magic demonstrated sustained value in user motivation, we observed predictable engagement decline patterns from Week 3 - reflecting the natural lifecycle of reward mechanisms and signalling opportunities for strategic refinement.

Solution #2

Spin to Win

A revamp of the existing Spin feature and giving it a new avatar. Leveraging Spin's position as our premier engagement driver, we transformed the mechanism into a powerful product discovery engine. This strategic integration of rewards and relevant offerings amplified user response, generating 2-3X higher click-through rates versus standard homepage placements.

Highlights

Contributes to above 20% manual saving transactions per month.

Spin has above 50% month-over-month engagement rate.

Problem Area #2

Transforming exploratory interest into confident engagement

About two-third of the users who create account on Jar, reach to home screen without having initiated saving on the platform. We tagged them as “Explorers”.

Day-one saving activation emerged as the defining retention predictor: users who bypassed saving opportunities in their initial session demonstrated only 10% organic return rates, crystallising the urgency of driving first-day saving engagement.

User questions during research

“I saw the ad and was just exploring, what does this app do”

“What do I have to do?”

“How does this app work”

Our point-of-view

“Explores” are the potential savers once they’ve been adequately informed about workings of saving on the platform. For these users, we should create a learning experience once they have sped through onboarding journey.

Make it Meaningful - Solution #1

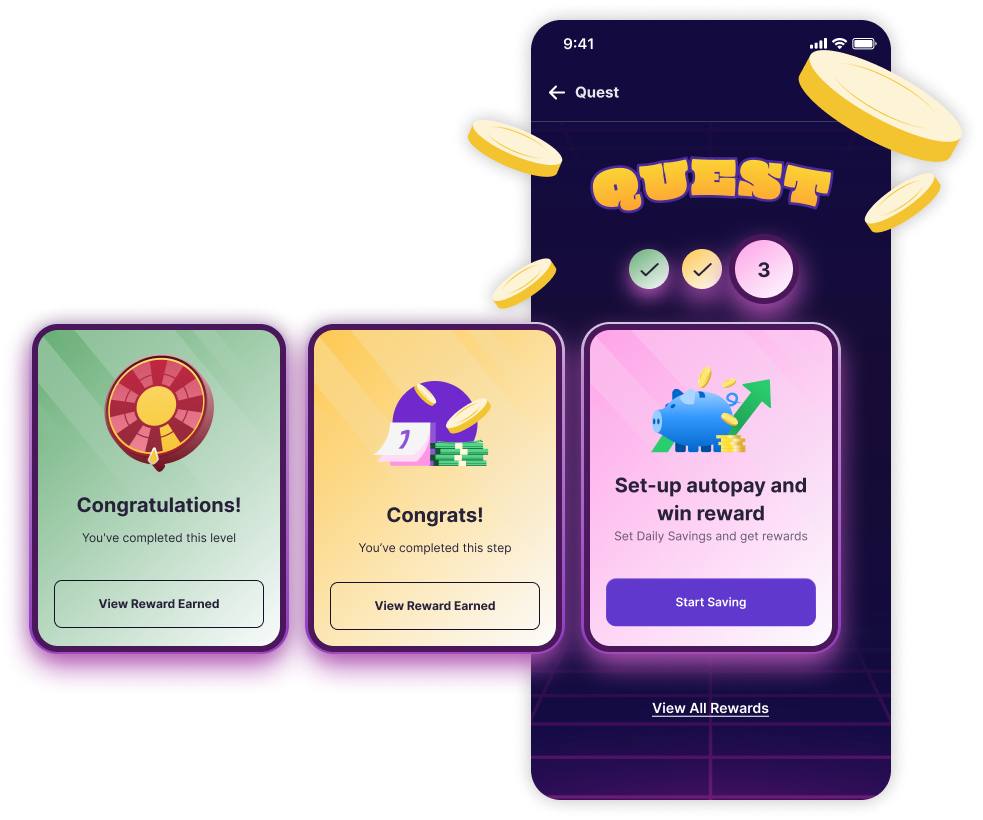

Quest

Unlocking different Quests based on the savings journey, interactions and engagements with the product

The construct of the game

A Quest is an interactive journey broken into smaller tasks, where users earn rewards for each milestone they reach. Completing all tasks unlocks access to the new Quest.

Quest is designed to be scalable, steps in quest could be customised as the user’s lifecycle and engagement journey on the platform.

Highlights

We saw encouraging and positive user behaviours upon making Quest live for a controlled crop of 20% of our DAU.

80+% of users who started the Quest completed more than 1 Quest task.

We were able to reinforce the basics of saving on Jar via multiple choice questions with 3 chances to provide a correct answer.

7% of the users who entered Quest, activated their Daily Savings.

Experiments for the focused discovery of new product offerings (in this case, a loan product we had launched) achieved higher CTRs.

Next steps: To scale and create tailored quests for unique user journeys.

Problem Area #3

Fostering a cohesive sense of meaningful progress

While Jar users currently benefit from various reward structures, there has been no unified journey for the users. The existing journey lacked a clear way for them to track the progression of their saving habits and the offered incentivising their consistent saving behaviour.

To create a more coherent experience, we designed a comprehensive savings and rewards framework that:

Seamlessly links a user's saving and reward milestones.

Provides an intuitive progress tracker so users can visualise and take pride in their advancement.

Offers meaningful rewards that feel closely tied to and are a validation of their consistent saving efforts.

Maximising Momentum - Solution #1

Savings streak

How it works?

To reinforce the benefits of consistent saving behaviour, we introduced a 7-day streak system. Users who maintain a daily saving habit for a full week will be rewarded with a special bonus, such as extra gold added to their savings and smaller rewards in between.

What pain point it address?

This 7-day streak incentive addresses a key friction point for many users - the applicable GST (government tax of 3%) on each saving, which was leading some to perceive Jar as a 'loss-making app'. Data analysis has shown that users who save for 5+ consecutive days have 25-30% better week-over-week retention rates.

Our goal?

By creating this gratifying 7-day savings journey, complete with a meaningful reward, we hypothesised that we can overcome the negative perception and instead foster a strong sense of progress and accomplishment. This should help drive higher user engagement and long-term retention as customers feel motivated to maintain their saving streak.

Why it made sense from a business perspective?

By strategically aligning our existing reward structures with the new 7-day streak mechanic, we were able to offer users a highly compelling Extra Gold bonus at the end of the streak - without increasing the overall 'burn' rate.

We recalibrated the initial 'Daily Saving' and 'Weekly Magic' rewards to help offset the reduction in net savings due to government taxes during those first critical 7 days. This approach converts what was previously seen as a 'loss-making' experience into a gratifying saving journey

Solution #2

Progression of streak to “Savings Target”

As the name suggests, we recommended savings target based on the user’s Daily Savings amount. We created milestones in this journey, to create opportunity to celebrate the user’s success on the progress.

(Keeping this brief as during my tenure the feature was not made live for me to share further insights)

Ending note

Our solutions helped us meet our user experience and business metrics to a good extent. There are new versions in the pipeline, based on the learnings from each solution. Each solution creates a virtuous cycle: meeting current metrics while uncovering new user patterns and behaviors. As users evolve through engagement, they reveal fresh opportunities for innovation. This continuous learning powers our product pipeline, ensuring our user experience stays ahead of emerging needs.

If you adopt anything from my experience at Jar, I hope you adapt it to your own context using your best judgment.

And that’s a wrap. Thank you.

Acknowledgements

Team members who contributed to bringing these ideas to life

Design team members: Riddhi, Lakshya, Sadaf, Swatishree and Sushant.

Product team members: Simran, Preksha & Samiksha from the Product team.