Recent Work

☆

Recent Work ☆

Making of the Onboarding Experience for Jar Users

About Jar

Jar is a fintech startup empowering millions of underserved Indians to build savings. Jar is transforming traditional financial barriers into opportunities for those who have historically struggled to build their savings.

Our solution addresses over 200 million Indians - from gig workers and small business owners to farmers and daily wage earners. With $60M+ in funding from Tiger Global, Rocketship, and other marquee investors ($300M+ valuation, Aug 2022), we're scaling financial inclusion across India.

My role in the project

As design lead, I merged analytical insights with creative direction to shape project foundations. Guided team excellence in storyboarding, visual design, and motion, while ensuring data-driven design decisions.

This project pioneered two new collaborative frameworks: one optimising design team dynamics, and another enhancing cross-functional partnerships.

What made user onboarding so important?

Onboarding is about building user confidence and empowering decision-making. Like teaching someone to ride a bike, we start with support, celebrate small wins, and gradually help users find their balance.

Onboarding proved to be a critical driver of business success for multiple reasons:

Revenue Impact

Highest conversion rates for Daily Savings, our primary revenue generator

Direct correlation between onboarding quality and user adoption

User Retention

Week-1 cancellations were primarily due to incomplete feature understanding

Better onboarding directly reduced early user churn

Cross-product adoption

Daily Savings users were 3X-6X more likely to use other products

Served as a gateway to our broader financial ecosystem

Organic growth

Active Daily Savings users became product advocates

Higher referral rates compared to non-Daily Savings users

Who are the users?

-

Arun Gopal

Mobile repair shop owner, Mumbai, Maharashtra.

✓ Saving for family and kids

✓ Earns on daily basis, so saving daily is convenient and easy

✓ Saves extra on days when there is extra daily earning

✓ Speaks Hindi fluently and knows some English but uses the Jar app in English

-

Lijin Matthew

Airport staff, Kochi, Kerala.

✓ Saving for the future

✓ Smaller daily saving is best suited as larger sum on monthly basis is not feasible

✓ Understands the value of gold and believes gold is the safest investment option always

✓ Speaks Malayalam, uses the Jar app in English

-

Sardar

Cab driver, Bangalore, Karnataka.

✓ Saving for family and kids,

✓ Used savings for car downpayment

✓ Uses Jar app as a secondary bank account, when there is no money in bank or wallet then uses Jar savings when required

✓ Speaks Hindi and Kanada, can not read & write english but uses the Jar app in english

-

Mohammed Sajid

Travel operator (DMC), Port Blair, Andaman & Nicobar Islands

✓ Saving for the education and marriage of his kids

✓ Post COVID-19, his conviction to build better savings is much stronger

✓ Trusts gold to be the best saving option as according him gold never goes down

✓Speaks fluent Hindi & English

Onboarding that inspires action

Reimagining the onboarding experience

🚩 Problem Area

Our user research revealed a critical insight: Our existing onboarding stories weren't sticking. Users retained minimal information about app features and benefits, leading to poor recall of Jar's core value proposition.

🎯 Target base

Cohort-1: D0 Users who created an account but did not start daily saving on Jar.

Objective: Improve Daily Savings setup conversion rate.

Cohort-2: D1 to D3 User, who started daily saving

Objective: To reduce the Daily Savings cancellation rate.

🏁 Starting with a Question

What core elements of our onboarding narrative create such a compelling value proposition that transforms first-time users into confident believers who think “This solution was made for me"?

Design Point-of-View (POV)

How might we design Jar's onboarding experience to inspire confidence in small, everyday savings so that users are motivated to start their savings journey today?

Breaking down the Design POV in 2 parts

Part #1: How might we design Jar's onboarding experience to inspire confidence in small, everyday savings …

Objective: Building confidence in Jar with stronger brand recall.

Part #2: so that Users are motivated to start their savings journey today.

Objective: Take their first confident step into “Daily Saving”.

From Understanding to Action: A Two-Part Journey

Building & Testing the onboarding narratives

1. Leveraging celebrity partnerships to build influence

User takeaways

Users had a good recall of the celebrity, many trusted the app because of that factor.

One can start saving with ₹10 on Jar.

Business impact

On-going 14% conversion on Daily Saving setup on D0.

Learnings ✨

User calling & Interviews

The initial uptick in conversion was not sustainable as most of the key aspects of savings on Jar were still missing.

2. The growth narrative of saving in gold

User takeaways

The only recall witnessed was that of ₹10 as the starting amount on Jar

The narrative of gold & growth was missed by most

Business impact

We saw a negative impact, there was a drop of 1-1.5% in users who chose to start saving with us

Learnings ✨

Users who chose the regional language showed no improvement in conversion or retention.

Recall of gold was still low.

Interestingly, the southern part of India performed poorly, eventually, we realised it was the ₹10 coin which is not accepted in most parts.

The lack of social proof created apprehension amongst users, and ongoing online frauds made the acceptance even tougher.

Experiment

We introduced language election as the first screen post the splash screen. Offering the regional language as the first option based on the user location tracking. For example in the case of Bangalore, the first language option shown was “Kannada”, then “English” & “Hindi” respectively. The experiment also included the introduction of gold as the safest asset class and with historic growth indication.

Success for Design POV Part #1

How might we design Jar's onboarding experience to inspire confidence in small, everyday savings…

Understanding of the key value propositions of micro-saving on Jar

✓ One can start saving with as small as ₹10 in gold.

✓ Saving will be done every day, automatically.

✓ One can withdraw their saving anytime.

✓ Millions of Indians trust Jar to build their saving.

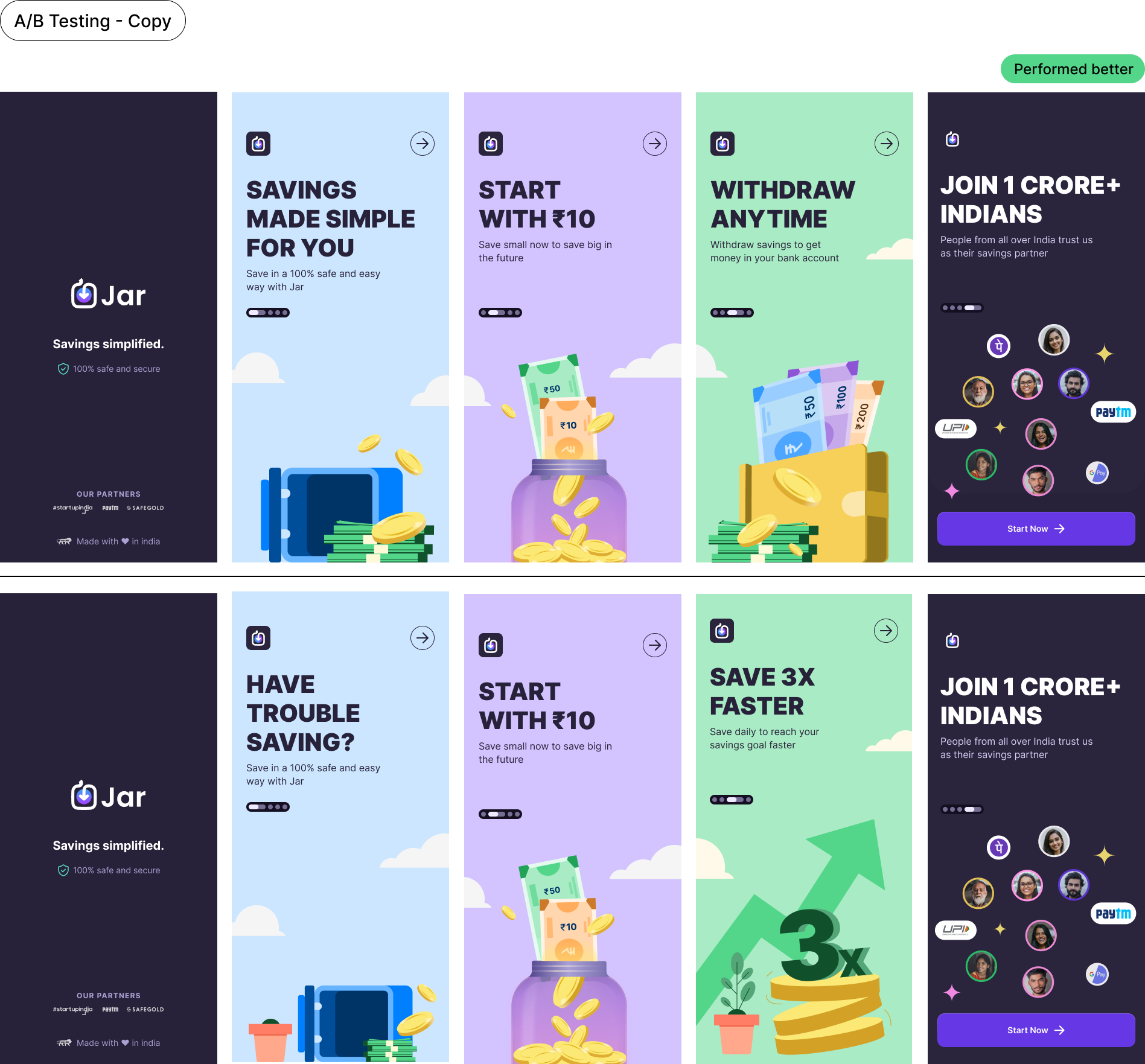

3. Storyboarding the key values of saving daily on Jar

User takeaways

Strong recall that one can start saving with ₹10.

Also one can withdraw the money anytime.

Social proof had a very positive impact, scale gave a sense of security. Paytm & UPI logos also added to the feeling of security.

Business impact

We saw a 3% uptick in the conversion for new users, from 14% to 17% conversion (complete onboarding flow) movement was achieved for the Daily Saving setup on D0.

Learnings ✨

User calling & Interviews

There was an expectation mismatch among the users who thought they were “Saving” vs those who thought they were “Investing”. People with an investment mindset had lower retention. However, there was mention of saving converting in gold users who made themselves aware of the same displayed higher retention. The facility to get the saved gold can be converted into real gold and delivered home, creating an “aha” moment for many. *

* Building on this foundation, we expanded the onboarding stories to test various savings incentives, laying groundwork for Design POV Part 2

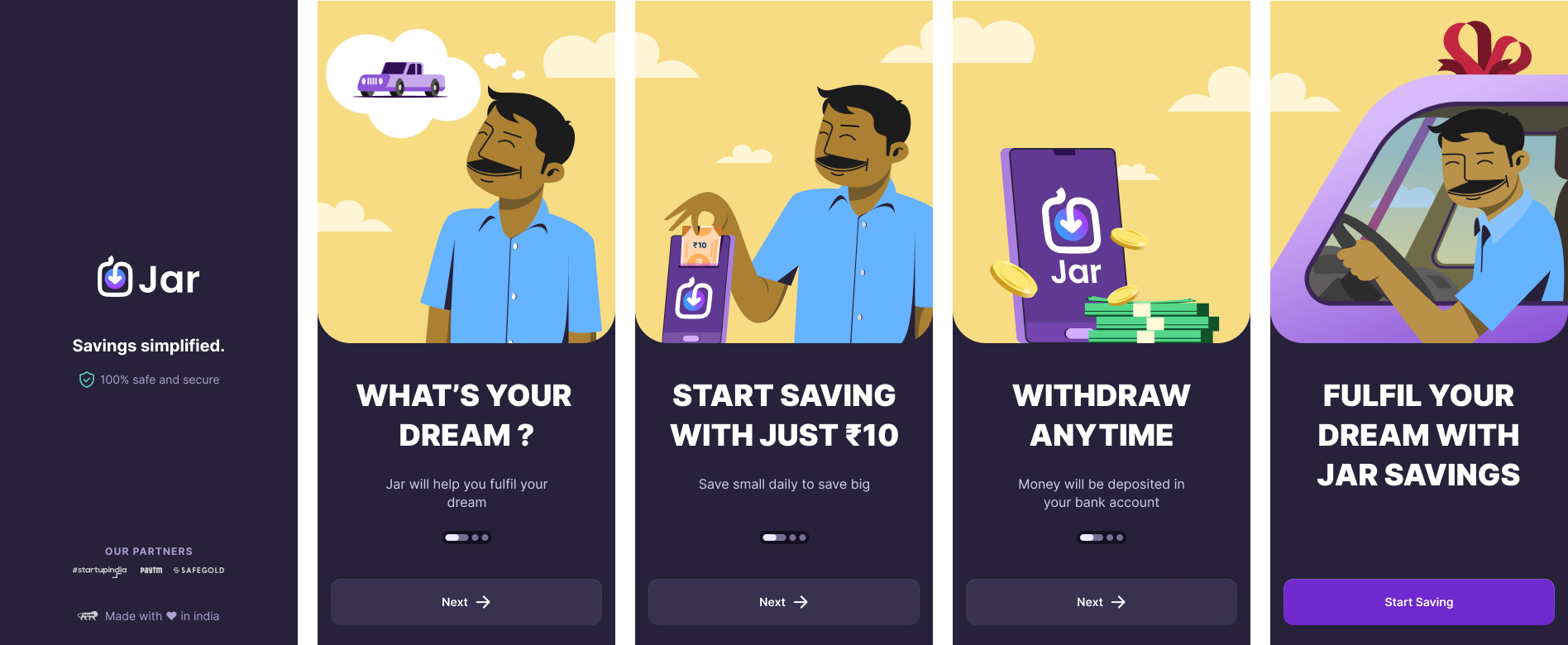

4. Building an aspirational narrative: Save for your dreams

User take-aways

User who saw this experiment, had a good recall of saving for car” and similarly “saving for future needs”

Many did mention about the idea of building a considerable amount by starting small.

Business impact

Little or no impact on the conversion or retention of users.

Learnings ✨

(Based on user interviews)

While financial goals exist, asking or directing users to define them during their first interaction with Jar creates friction. These aspirations are typically fluid early on, suggesting we should focus on building comfort with saving habits before introducing formal goal-setting.

Also, the human figure took much more attention than the explanation for the value propositions.

Experiment

Illustrating a story of someone who fulfilled his dream of buying car with his saving on Jar. Building on the proverb “drop by drop fills the ocean”, as this proverb transcends many languages and cultures.

Part #2 of Design POV

How might we design Jar's onboarding experience to inspire confidence in small, everyday savings so that Users are motivated to start their savings journey today.

1. Enhancing user comprehension of daily saving

Learning ✨

Post account creation, the animated introduction to “Daily Saving” proved instrumental in building user confidence and driving action. Our A/B test revealed its true impact: removing the animation for a shorter onboarding led to a 4% drop in Daily Saving setup rates. This validates that helping users visualise their saving journey is worth the extra onboarding time, as it directly influences their decision to commit.

2. Optimising for action

We strategically focused on optimizing the crucial final step of the onboarding flow - the user's decision to activate 'Daily Saving'. Through multiple A/B testing of various action-driving signifiers and intent-building mechanisms, we identified two highly effective approaches: 'Efficient Saving Method V1.1' and 'Efficient Saving Method V2.

Business impact

These optimisations yielded significant results, improving the “Daily Saving” setup conversion rate by 3% points to reach 23% - a meaningful boost at this critical decision point in the user journey.

Insights that shaped our final onboarding

Insights in action

Learnings ✨

✓ Thoughtful onboarding pacing to improved user comprehension, discouraging rapid click-through behaviour

✓ Transformation and motion captured user’s attention better

✓ Unified visual cues strengthened user understanding

✓ Mentioning India visually and textually creates a sense of security

✓ User base of Jar enforces the sense of security further

Impact ✨

The average time spent on onboarding stories increased, resulting in better comprehension (based on initial user calling)

Reached 27% activation rate for Daily Saving from onboarding (we started with 14% conversion rate)

Disclaimer: Research and analysis was not complete at the time of creating this case study.

Acknowledgements

Design team members who contributed to the ideations, UX, visual and motion design to bring these ideas to life. Particularly, Nitesh (Product design), Swatishree (Visual design) and Sushant (Motion & visual design).

Other articles & case studies

Dialogue in designing digital interfaces

-

My point-of-view of designing digital interfaces. In digital interface design, if we’re not choreographing a dialogue between a user and the screen then we’re not designing — we’re just making boxes…

Crafting immersive product experiences…

-

This is a collection of some of the work done at Jar where we used game design principles to build immersive product experiences for our users on Jar app.

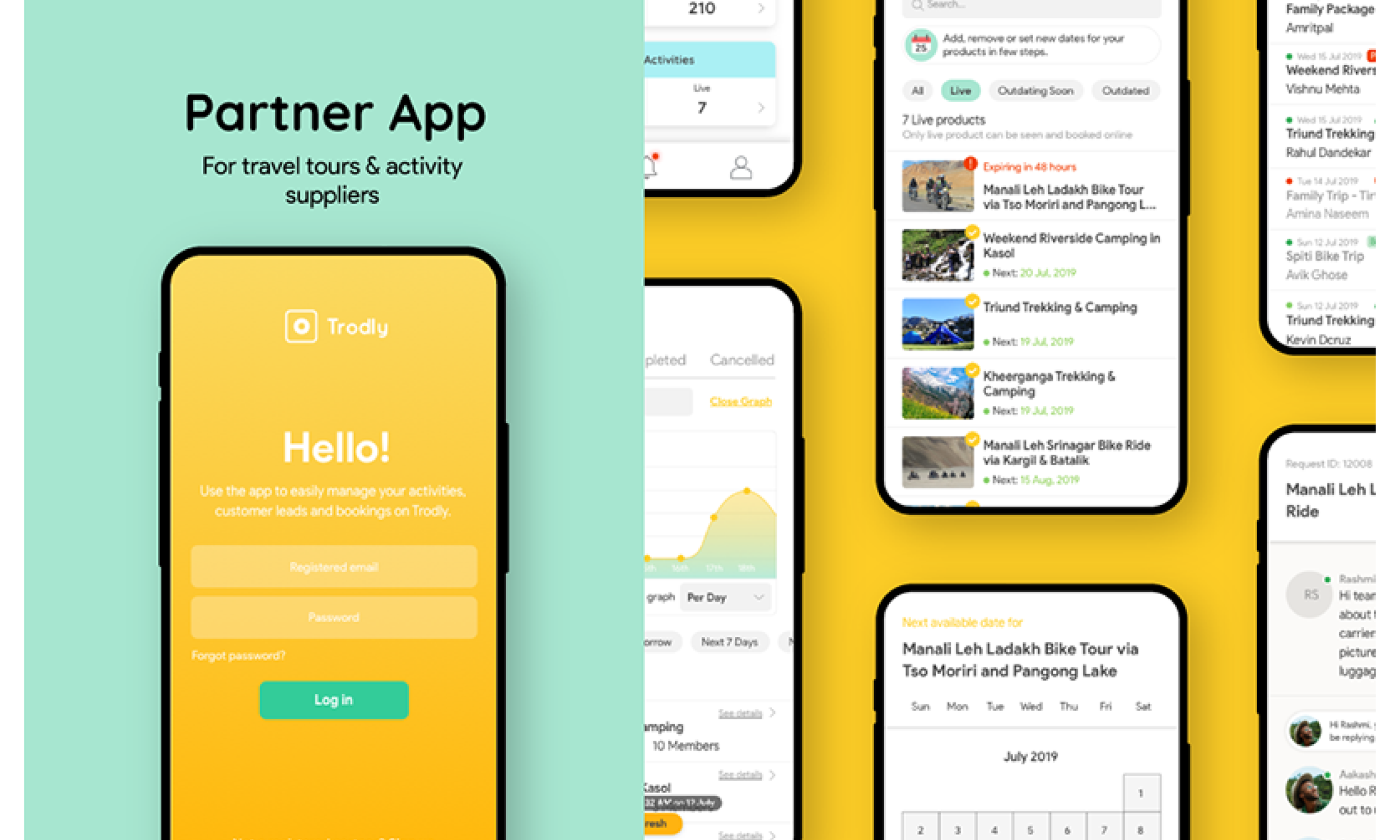

Travel management platform for businesses…

-

App designed for travel business’s 3 key essential functions - Listing travel products, lead nurturing and booking management.